Mobile commerce refers to the use of wireless handheld devices like smartphones and tablets for online shopping and transactions and has seen tremendous growth in recent years. It’s where users can perform online transactions anytime, anywhere, powered by the Internet. Compiling key statistics from reputable industry research provides a data-driven overview of mobile commerce adoption, sales, trends, and future outlook.

Key Takeaways

- Mobile commerce sales are growing rapidly, expected to exceed $3 trillion globally by 2027. Smartphones now account for over 60% of ecommerce transactions.

- 5G mobile subscriptions are projected to reach 5 billion by 2028, covering 85% of the population and handling 70% of mobile traffic.

- Mobile commerce sales are expected to exceed $3 trillion by 2027, accounting for 62% of total e-commerce.

- Top online purchases include clothing (44%) and shoes (34%). Cart abandonment rates are higher on phones at 80% vs. 74% on desktops, impacting conversion.

- Social commerce is rising, with 40% of social media users following influencers and 30% purchasing based on their recommendations.

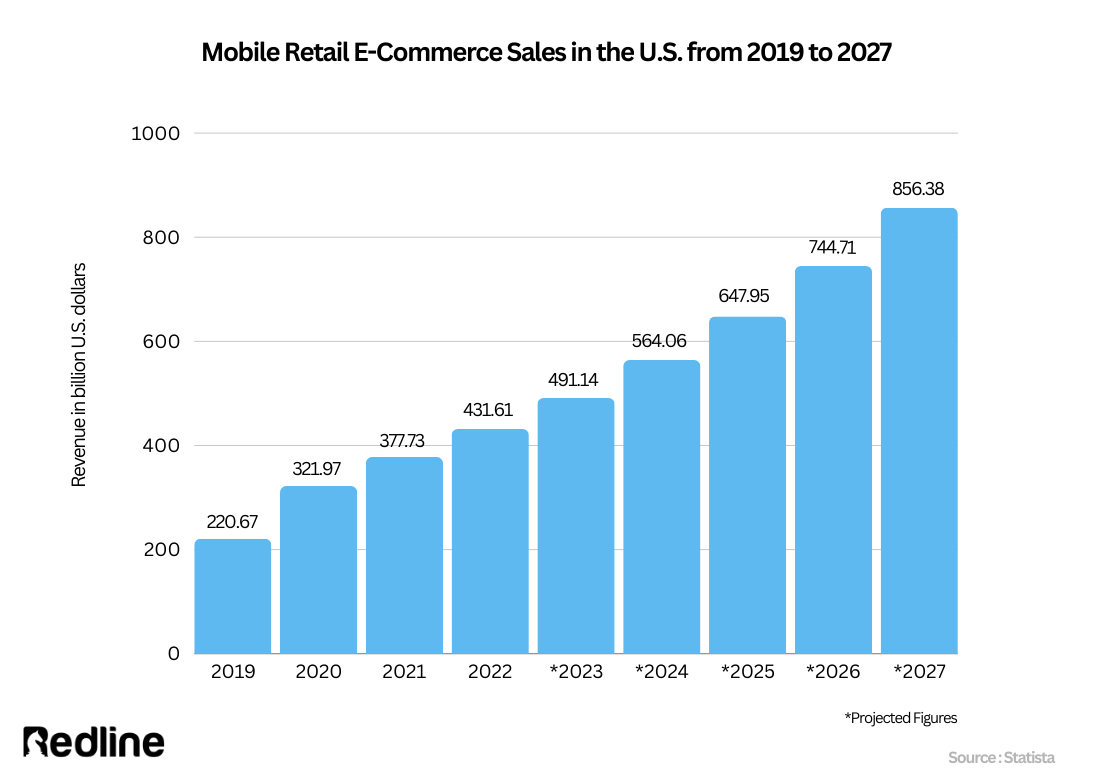

- Mobile commerce sales in the U.S. are expected to grow from $360 billion in 2021 to around $710 billion by 2025.

- 80% of digital sales in Asia Pacific come from mobile.

- In APAC, 77% of internet users aged 16-64 purchase products online via mobile phones weekly.

- U.S. retail m-commerce sales reached $387 billion in 2022.

- Smartphones account for 87.2% of mobile commerce sales.

- The mobile payment market is expected to grow from $52.21 billion in 2023 to $905.0 billion by 2028, with a CAGR of 29.5%., as digital wallets like Apple Pay gain traction.

Mobile Commerce Adoption

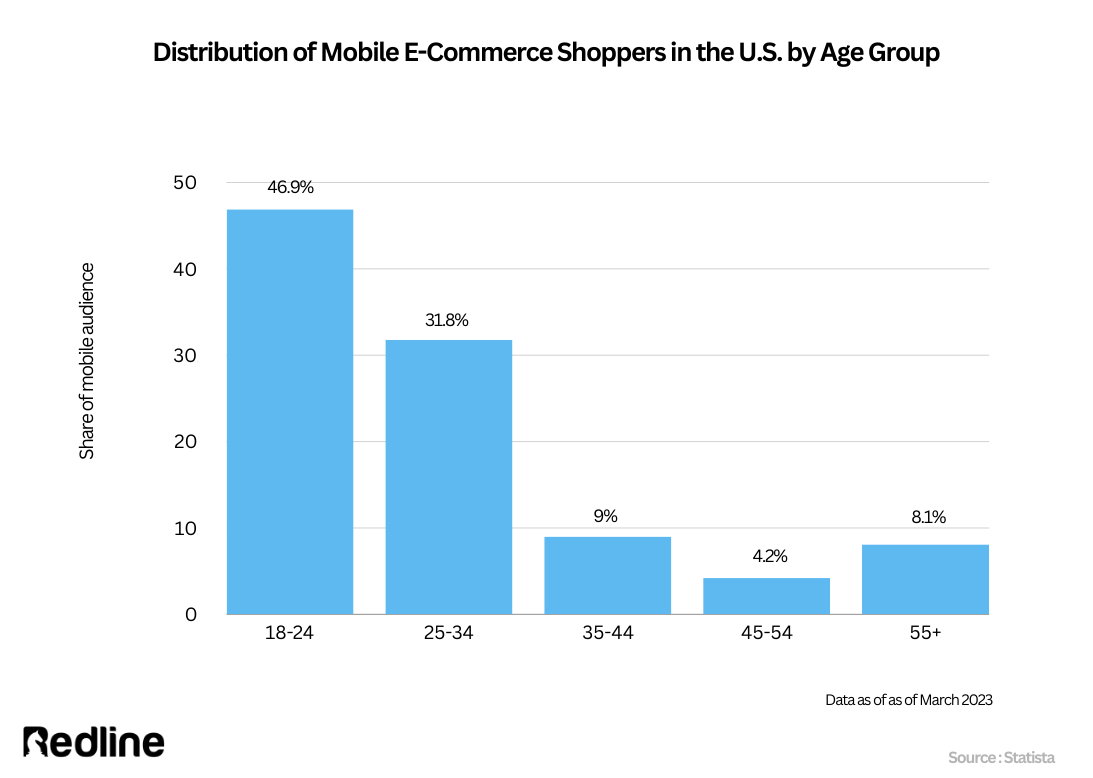

Mobile commerce adoption continues to accelerate globally, led by younger demographics and supported by advancements in mobile technology. Key metrics show high and growing usage of smartphones for online shopping amongst U.S. adults under 50, rising mobile subscriptions and transition to 5G networks worldwide.

- 91% of U.S. adults ages 18-49 say they buy things online using a smartphone.

- 69% of U.S. adults ages 50-64 and 48% of those 65+ say they buy things online using a smartphone.

- Adults with higher incomes are more likely to use a smartphone for online purchases compared to middle- and lower-income adults. 76% of U.S. adults say they buy things online using a smartphone.

- In 2022, the total number of mobile subscriptions globally was expected to reach around 8.4 billion.

- The transition toward 5G is accelerating demand for advanced mobile devices. According to the Ericsson Mobility Report (Nov 2022), 5G mobile subscriptions are expected to reach around 5 billion by 2028.

- During the same period, 5G population coverage is estimated to reach 85%, while 5G networks are anticipated to carry around 70% of mobile traffic.

- The growth is driven by consumers spending more time on phones/tablets and valuing the convenience of shopping online anywhere, leading to further growth expected

Mobile Shopping Behavior

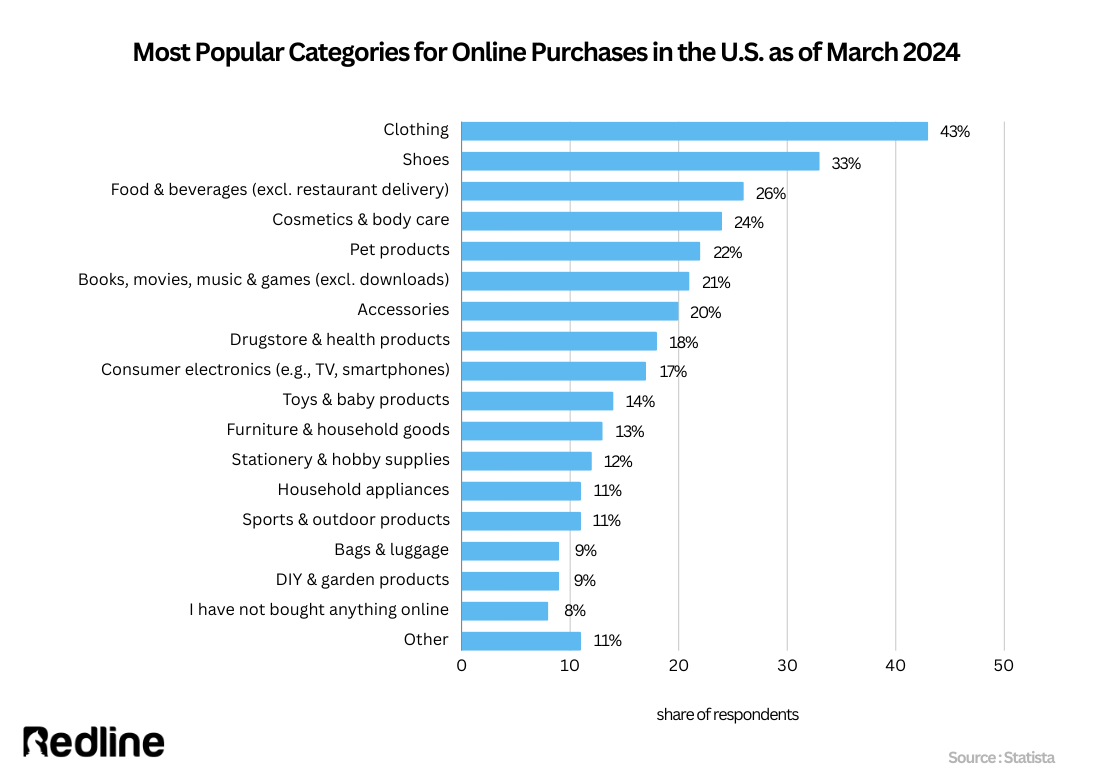

Online shopping has become a go-to for Americans seeking out apparel and footwear. The survey showed that clothes were the top online purchase, selected by 44% of respondents, while shoes followed closely behind as the second most popular category, chosen by 34%.

This indicates that consumers strongly prefer the convenience and selection of fashion items from the comfort of their homes. For many, it beats venturing to crowded stores and malls.

Beyond attire, certain specialty items also attract online shoppers. Over 1 in 4 respondents bought cosmetics and skincare online. The variety and ease of comparing products make the internet enticing for beauty purchases. Pet products were similarly popular, likely due to the wide assortment of foods, toys, and supplies available at the click of a button.

While clothes and shoes appeal more to fashion-focused spenders, electronics and media also drive a sizable portion of e-commerce. About 1 in 5 respondents bought books, movies, music, video games, or consumer tech devices like smartphones online. The streamlined digital commerce experience continues ushering traditional in-store shoppers towards online alternatives.

Here is the graph from the survey on the most popular categories for online purchases in the U.S. from July 2022 to June 2023:

- Clothing - 44%

- Shoes - 34%

- Bags and accessories were selected by 26% of respondents.

- Food and beverages (excluding restaurant delivery) were selected by 26% of respondents.

- Cosmetics & body care were selected by 24% of respondents.

- Pet products were selected by 23% of respondents.

- Books, movies, music & games were selected by 22% of respondents.

- Accessories were selected by 21% of respondents.

- Drugstore & health products were selected by 19% of respondents.

- Consumer electronics like TVs and smartphones were selected by 18% of respondents.

- Toys & baby products were selected by 15% of respondents.

- Furniture and household goods were selected by 13% of respondents.

Research shows distinct trends in how consumers use mobile devices for online shopping, including demographic variations in platform preference, cart abandonment rates, and frequency of mobile purchases. Notable statistics indicate lower conversion rates on mobile, generational and income differences in usage patterns, the popularity of apps like Amazon and Shein among young shoppers, and how factors like screen size impact mobile commerce behavior.

- U.S. mobile phone conversion rates have consistently been lower than for desktops or tablets.

- 72% of White adults and 84% of Asian adults say they use a computer to buy things online, compared to 61% Black adults and 57% Hispanic adults.

- There are no statistical gender differences for online purchasing via smartphone or tablet.

- Men are more likely than women to report buying things online using a computer (72% vs. 66%).

- On phone devices, the cart abandonment rate shot up to 80.79%, compared to 73.93% on desktop, a 6.86% difference.

- 32% of U.S. adults say they use a smartphone to buy things online at least weekly. 21% say they use a desktop/laptop to buy things online at least weekly, while 7% say they use a tablet to buy things online at least weekly.

- 49% of U.S. adults ages 30-49 shop online via smartphone at least weekly. Upper-income households are more likely to shop weekly via smartphone or desktop/laptop compared to middle- and lower-income households.

- 57% of U.S. adults say they generally prefer in-person shopping over online shopping. Adults under 50 are more likely than those 50+ to say they prefer to shop online.

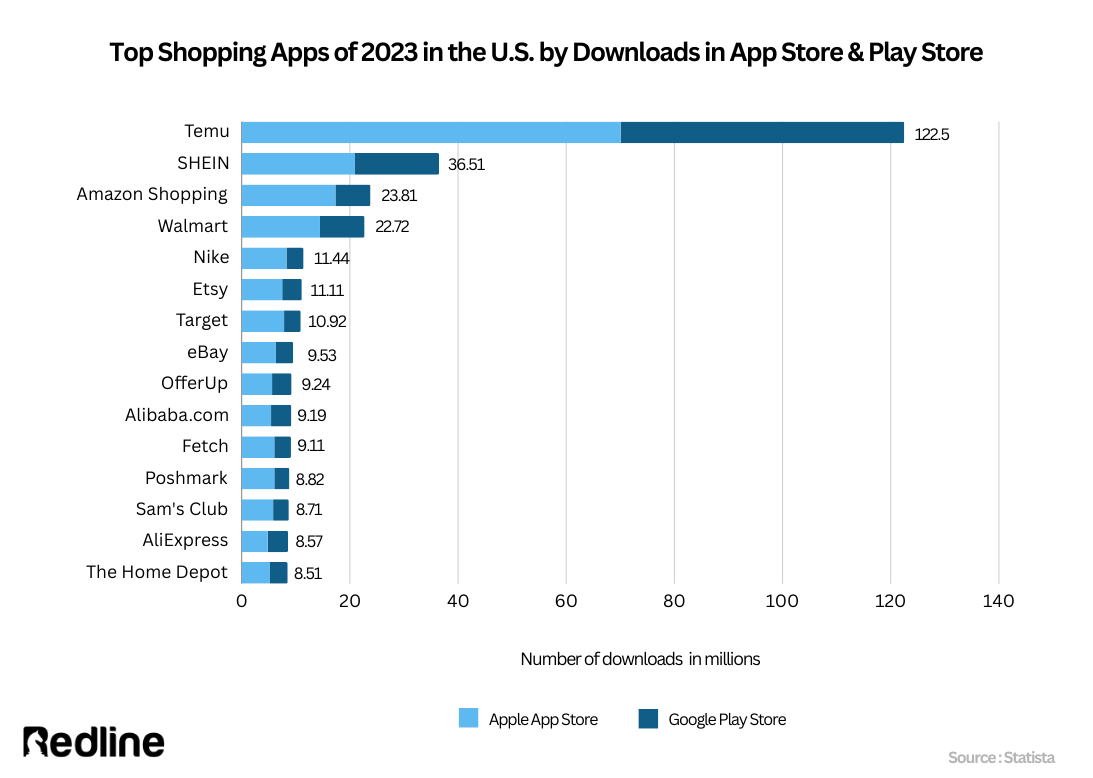

- The top shopping app in the U.S. is Amazon's app, with almost 35 million downloads in 2022 across iOS and Android.

- Shoppers ages 18-34 make up the majority of shopping app users. Amazon's app is also the leading marketplace app in the U.S. The Shein app is the top fashion/beauty shopping app with the most downloads.

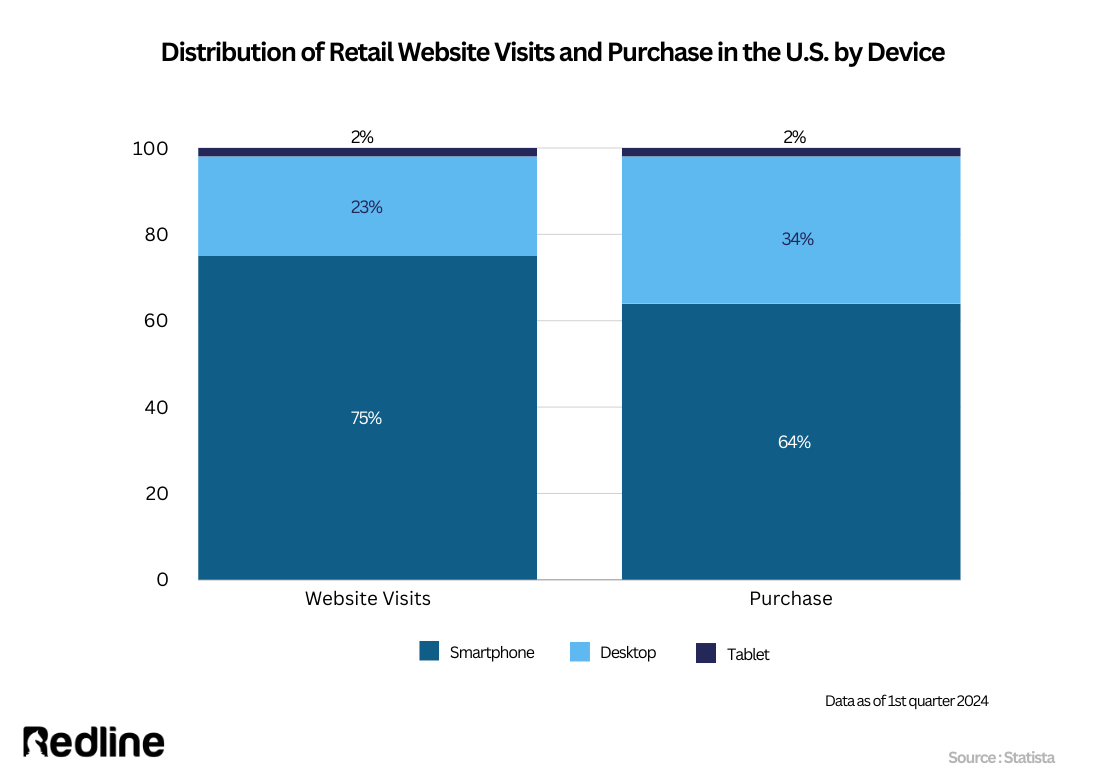

Globally, mobile is now the device of choice for all stages of the online purchase journey - from researching to buying to reviewing. Consumers who buy products online on mobile are also likely to buy on PCs/laptops and vice versa. Browsing products and visiting retail websites is a multi-device activity, showing the need for a multi-device approach throughout the purchase journey.

- Internet users over 45 still prefer devices with larger screens like PCs and laptops.

- In North America, more 16-24-year-olds are purchasing products on their PC/laptop (46%) than 55-64-year-olds in APAC (39%) and Middle East & Africa (38%).

- Most consumers engage in m-commerce on their smartphones rather than tablets.

- Over 20% of U.S. shoppers ages 50-64 use m-commerce at least once a week from their phones.

- 11% of U.S. shoppers over age 65 also report weekly m-commerce shopping.

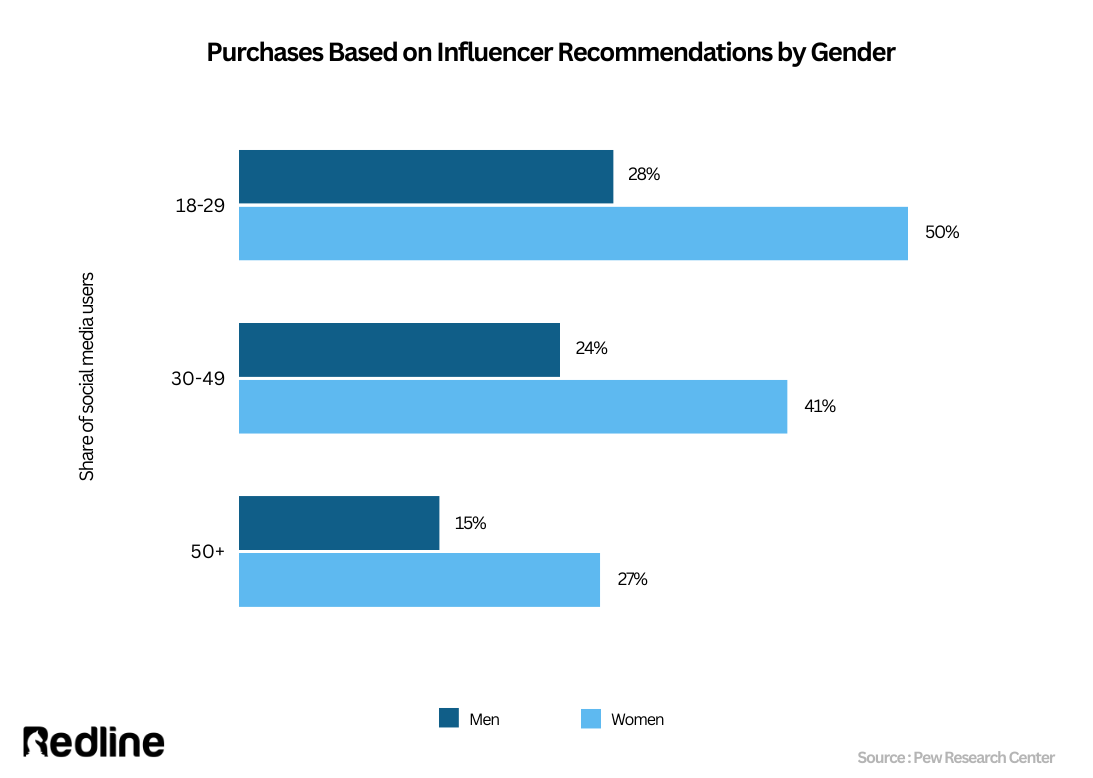

Social media has given rise to a new kind of marketing through influencers and content creators. Recent research by the Pew Research Center highlights how a substantial portion of social media users, especially younger demographics, are following and making purchasing decisions based on influencer recommendations.

- 40% of social media users follow influencers or content creators, and about 72% of 18-29 year old social media users follow influencers.

- 60% of women social media users under 50 follow influencers, compared to 47% of their male peers.

- 30% of adult social media users have purchased something after seeing an influencer post about it.

- 53% of users who follow influencers have purchased something after seeing an influencer post.

- Younger and female social media users are more likely to purchase after influencer posts. 48% of Hispanic and 43% of Black social media users say influencers impact their purchases, compared to 33% of White users.

- 39% of social media users say influencers impact their purchase decisions at least a little, with 3% saying influencers have a lot of impact.

- 54% of 18-29-year-old social media users say influencers impact their purchases to some degree. 62% of young women ages 18-29 on social media say influencers affect their buying habits.

Mobile Commerce Sales

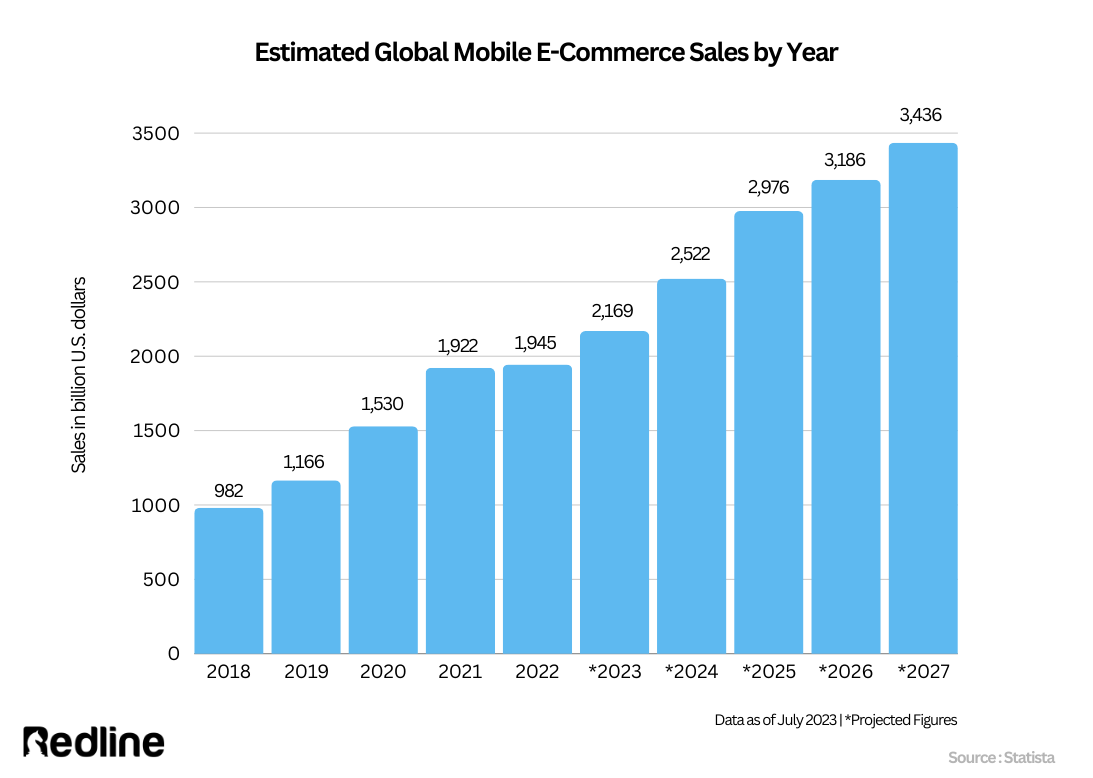

Recent statistics from industry analysis show substantial increases in global mobile commerce sales, with mobile accounts for over 60% of all e-commerce and sales projected to exceed $3 trillion by 2027. The continued growth of mobile commerce sales is driven heavily by smartphone shopping.

- The global mobile commerce market size is expected to grow from USD 420.2 billion in 2023 to USD 1,709.6 billion by 2028, registering a CAGR of 32.4% during the period.

- Mobile commerce sales are expected to account for 6% of all retail sales ($415.93 billion) in 2023

- Worldwide mobile e-commerce sales reached $2.2 trillion in 2023, making up 60% of all e-commerce sales globally

- In Q1 2023, US retail e-commerce sales reached USD 273 billion, with e-commerce share at 15.1% of total retail.

- The share of mobile e-commerce in total e-commerce has grown from 56% in 2018 to an expected 62% in 2027

- Mobile e-commerce sales have increased steeply as the whole sector expands globally, from $982 billion in 2018 to an expected $3.4 trillion in 2027

- M-commerce sales are predicted to hit $534.18 billion in 2024, making up 40.4% of total e-commerce sales.

- Smartphones account for 87.2% of m-commerce sales currently.

- Tablet m-commerce sales are expected to decline from $61.08 billion in 2022 to $54.01 billion in 2026. The decline in tablet commerce is attributed to overall tablet use decreasing and improvements in the mobile shopping experience.

Mobile Payment Statistics

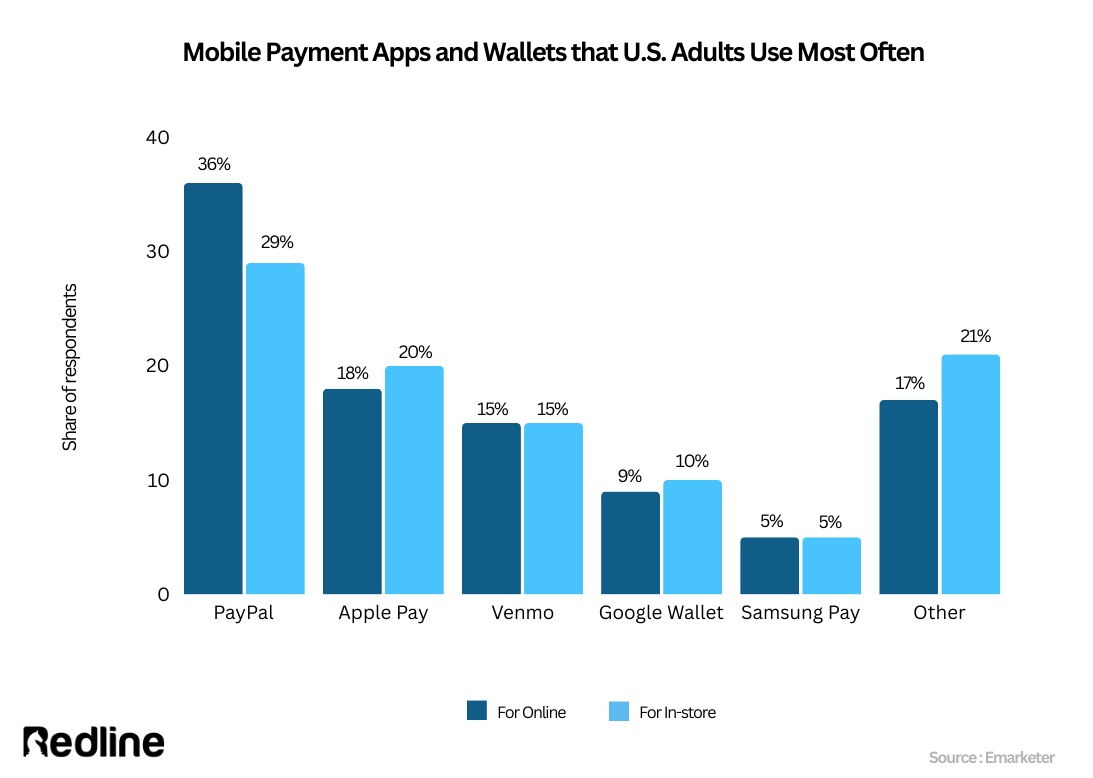

Mobile billing has become increasingly popular in recent years, making it easier to shop and pay without cash or cards. The mobile payments industry is expected to see significant growth in the coming years, driven by factors like the adoption of sound wave-based payments, smartphone growth, particularly Android phones, and rising usage in emerging economies thanks to ease of use, smartphone penetration, and financial inclusion capabilities.

However, security issues with mobile payments and increasing high-profile data breaches worldwide may restrain industry expansion. At the same time, COVID-19 has increased demand for contactless payments, further driving mobile payment market growth. Key segments in the industry are Payment Type, including NFC, QR-based, online digital, and text-based, and Geography, spanning North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The m-commerce market is fragmented with key players like Ericsson, Gemalto, Google, IBM, Mastercard, PayPal, SAP, and Visa. MobiKwik plans an IPO in 12-18 months. ShipStation and Constant Contact partnered to sync customer data.

- The mobile payments market is estimated to be USD 52.21 billion in 2023 and is expected to reach USD 905.0 billion by 2028, growing at a CAGR of 29.5% as more shops accept payments through various applications like Paypal, Amazon Pay, and Apple Pay.

- According to a report by Great Works Internet, globally, PayPal is used by the highest number of internet users (62% in Latin America, 28% in Asia-Pacific) and is most advocated. Visa and Mastercard also have high global usage but less than PayPal.

- In countries where mobile payments are used most, local providers dominate over global ones.

- When Denmark's MobilePay was rolled out to all Danish payment card and phone number holders by DanskeBank, it dominated the market. MobilePay achieved ubiquity in Denmark that global providers haven't used for P2P, in-store, etc.

- Each mobile payment market is shaped differently by local players. 27% of online consumers globally have used a mobile payment service like Apple Pay, and 33% in Asia-Pacific.

Regional Mobile Commerce Stats

Statistics from research firms indicate the prevalence and continued growth of mobile commerce across key global markets, with countries in the Asia Pacific often leading in adoption. Regional data shows high mobile shopping rates in APAC and developing markets, while North America and Europe have lower but still substantial m-commerce activity amongst internet users.

- In 2022, there were over 299 million internet users in the US, up from 87% in 2020 to 92% in 2023.

- Retail m-commerce sales in the U.S. exceeded $360 billion in 2021.

- By 2025, U.S. retail m-commerce sales are forecast to grow to around $710 billion, almost twice the 2021 figure.

- Nearly 1/3 of U.S. internet users bought something online each week via a mobile phone as of late 2022.

- In 2022, mobile retail e-commerce spending in the U.S. surpassed $387 billion, more than double the spending in 2019 prior to the COVID-19 pandemic.

- In Asia Pacific, mobile sales represented about 80% of digital sales. The use of mobile devices for online shopping was more prevalent in regions of the global south compared to other parts of the world.

- In APAC, 77% of internet users aged 16-64 purchase products online via mobile phone per week. In Latin America this is 58% and in Middle East & Africa it is 57%. North America has the lowest share at 44% and Europe at 54%.

- The market value of the e-commerce industry in India was around USD 84 billion in 2021 and is estimated to reach USD 350 billion by 2030.

- As of Q3 2022, South Korea had the highest share of internet users who bought something online per week via a mobile phone, at 44.3%. Chile, Malaysia, and Taiwan were at 37.7%.

- As of April 2023, the global average internet penetration rate was around 64.6%. Northern Europe ranked first at 97%, and Western Europe second at 93.5%.

Growth in smartphones and internet penetration is driving m-commerce market growth. Smartphone adoption is increasing globally, advancing to 5G networks. Recent statistics from China and the US mobile market provide insights into trends in the mobile phone market, including shipments of 5G devices and growth projections for smartphone sales revenue.

- Chinese 5G mobile phone shipments reached 173 million in the first 10 months of 2022, down 17.7% from the same period last year.

- In October 2022, shipments of 5G mobile phones in China neared 19.52 million, accounting for 80.1% of total mobile phone shipments. 20 new 5G mobile phone models were released in China in October 2022, up 25% year on year. Chinese brands represented 69% of China's total mobile phone shipments in October 2022, with 16.8 million units shipped.

- Smartphone sales value in the US is expected to increase from USD 73 billion in 2021 to USD 74.7 billion in 2022.

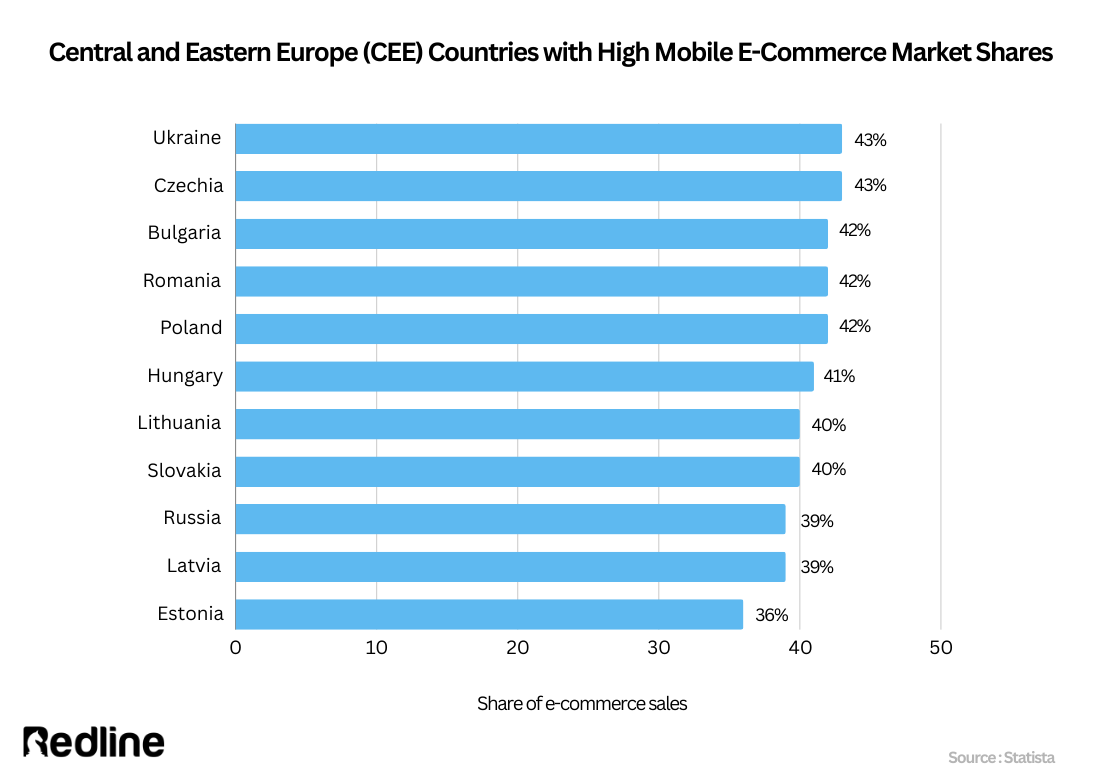

Overall, mobile commerce accounted for a significant portion of e-commerce transactions across Central and Eastern European countries in 2022, ranging from 36-43%

- Ukraine and Czechia had the highest mobile e-commerce market share in Central and Eastern Europe (CEE) in 2022 at 43% each. This means nearly half of all e-commerce transactions in Ukraine and Czechia occurred on mobile devices.

- Other CEE countries with high mobile e-commerce market shares in 2022 were:

- Bulgaria, Romania, Poland - 42%

- Hungary - 41%

- Lithuania, Slovakia - 40%

- Russia, Latvia - 39%

- Estonia had the lowest mobile e-commerce share in CEE at 36% in 2022

Conclusion

The meteoric rise of mobile commerce is projected to continue, with global m-commerce sales potentially exceeding $3 trillion by 2027. This growth will be fueled by smartphones becoming the primary devices for online shopping and transactions, supported by advancing mobile technologies like 5G networks and innovations such as sound wave-based payments. While adoption is strongest in developing markets currently, increased usage by younger demographics points to mobile commerce becoming ubiquitous across age groups and regions in the coming years.

Players like Amazon, PayPal, and Visa will continue leading the fragmented landscape, challenged by disruptive local providers. Concerns around security and privacy may temper growth somewhat but are unlikely to stem the overall momentum. With augmented reality and further enhancements on the horizon, the future looks overwhelmingly mobile when it comes to how consumers shop and pay worldwide.

FAQ

What percentage of U.S. adults use smartphones for online shopping?

91% of U.S. adults aged 18-49 use smartphones for online shopping, according to Pew Research Center data.

What is the projected growth of the global mobile commerce market?

The global mobile commerce market is expected to grow from $420.2 billion in 2023 to $1,709.6 billion by 2028, with a compound annual growth rate (CAGR) of 32.4%, as reported by Mordor Intelligence.

Which age group prefers online shopping in the U.S.?

Adults under 50 in the U.S. are more likely to prefer online shopping, with 57% stating their preference for in-person shopping, as per Pew Research Center findings.

What is the most downloaded shopping app in the U.S.?

Amazon's app is the top shopping app in the U.S., with almost 35 million downloads in 2022 across iOS and Android, according to Statista.

Which category of products do online shoppers prefer in the U.S.?

Clothing is the most preferred category for online shoppers in the U.S., with 44% of respondents selecting it as their top online purchase, followed by shoes at 34%, based on Statista's survey.

What is the current share of mobile e-commerce in total e-commerce sales globally?

Mobile e-commerce accounts for 60% of all e-commerce sales globally, as estimated by Statista.

Which demographic group follows and makes purchasing decisions based on influencers on social media?

72% of social media users aged 18-29 follow influencers or content creators, and 60% of women social media users under 50 follow influencers, according to Pew Research Center data.

How does mobile shopping behavior differ from desktop shopping?

U.S. mobile phone conversion rates have consistently been lower than for desktops or tablets, as reported by Statista.

What role does 5G technology play in mobile commerce growth?

According to the Ericsson Mobility Report, 5G mobile subscriptions are expected to reach around 5 billion by 2028, with 5G networks anticipated to carry around 70% of mobile traffic, as well as accelerating demand for advanced mobile devices.

What is the market value of the e-commerce industry in India?

The market value of the e-commerce industry in India was around USD 84 billion in 2021 and is estimated to reach USD 350 billion by 2030, according to Mordor Intelligence.

Which regions have the highest mobile shopping rates?

The Asia Pacific (APAC) region leads in mobile shopping, with 77% of internet users aged 16-64 purchasing products online via mobile phones per week, as per data from Great Works Internet.

What is the cart abandonment rate on mobile devices compared to desktops?

The cart abandonment rate on mobile devices is higher, at 80.79%, compared to 73.93% on desktops, based on Barilliance data.

How do men and women differ in online shopping behavior?

Men are more likely than women to report buying things online using a computer (72% vs. 66%), according to Pew Research Center findings.

What percentage of U.S. adults shop online weekly via smartphone?

49% of U.S. adults ages 30-49 shop online via smartphone at least weekly, based on Pew Research Center data.

Which brands dominate the fragmented mobile payments market?

Key players like PayPal, Visa, and Mastercard are widely used globally, with PayPal being the most advocated, according to Great Works Internet's report.

Sources