As we rely more and more on technology, we tend to use our devices for daily activities. Whether it’s for shopping, checking the weather, and even our daily news consumption. For plenty of people, newspapers are a thing of the past. However, this is far from the truth. Despite the US losing newspapers at a rate of two per week, the newspaper industry will never go extinct. We’re currently under a crisis for our democracy and a battle against disinformation, making national and local journalism more necessary than ever.

Key Takeaways

- The United States has 16 large newspaper owners. Gannett, the owner of USA Today, tops the list with 487 total newspapers in 2022. This is followed by Tribune/MediaNews Group with 190 newspapers, Lee Enterprises with 152 newspapers, Adams Publishing Group with 142 newspapers owned, and Paxton Media Group with 120 newspapers.

- Three of the largest US newspapers have lost more than 500,000 in print circulation between the first quarter of 2020 and March 2021. USA Today experienced the biggest loss in print circulation with 303,000 or 62%. This is followed by The Wall Street Journal with 208,000 or 21% of loss in circulation, and The New York Times with 48,000 or 12% of lost circulation.

- In light of the recent writers’ strike, the headcount in some newspaper companies fell by as much as 90%. In Gannett alone, the workforce shrunk by 47% — this is on top of the 6% cut in its 3,400-person US media division last year. But aside from these, the employment in newspaper companies continues to decline. In 2021, 11% of high-circulation newspapers experienced layoffs. At the same time, 3% of digital-native news experienced layoffs.

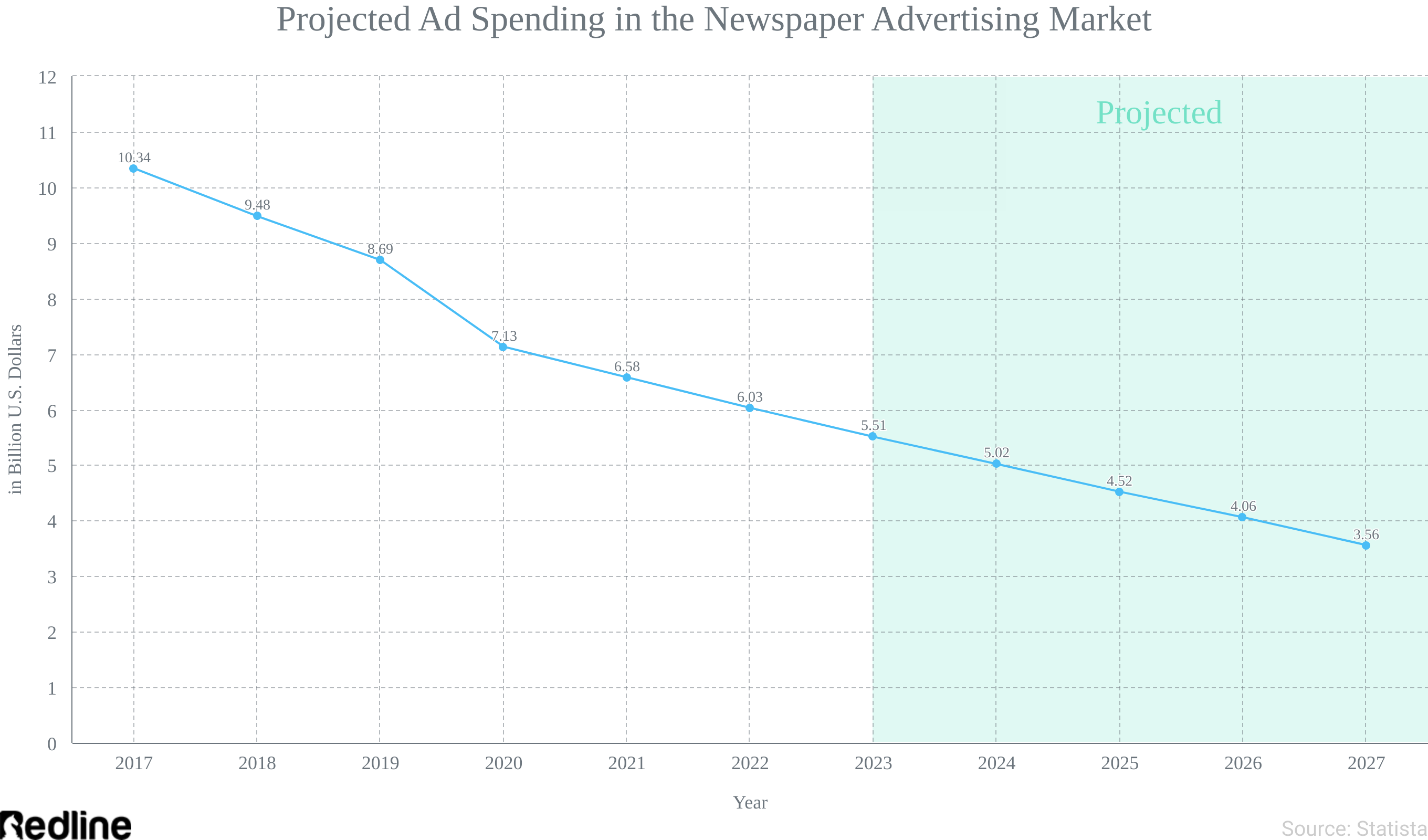

- US newspaper publishers are expected to lose $2.4 billion in ad investment between 2021 and 2026. The annual growth rate expected from newspaper ad spending between 2023 and 2027 is -10.34%. With such a growth rate, the expected market volume in 2027 is $3.56 billion.

Industry Insights

The US newspaper industry goes way back to the 1600s. As times changed, the industry has changed as well. Here are some figures to know what changed in the industry over the recent years.

- The United States accounts for 21% of consumers who pay for online news content in 2022. The country holds the 4th position, sharing with Finland, with 21%. The country with the highest percentage of online news content consumers is Norway with 39%.

- In 2022, there are 16 largest newspaper owners in the United States. Gannett tops the list with 487 total papers, followed by Tribune/MediaNews Group with 190, Lee Enterprises with 152, Adams Publishing Group with 142, and Paxton Media Group with 120.

- As of 2022, Gannett is the largest newspaper owner in the United States with a total of 487 papers owned. The company owned fewer papers in 2022 than in 2020 (613 papers owned).

- About 3 privately owned regional chains started owning newspapers in 2022. These are CherryRoad Media of New Jersey, Paxton Media, and Ogden Newspapers. These chains are the largest regional newspaper owners.

- About 2/3 of the 90 papers sold by Gannett were bought by CherryRoad Media and Paxton Media. CherryRoad Media owns 71 papers in 10 Midwestern states, while Paxton Media owns 120 papers in 10 Southern and Midwestern States.

- In 2021, the circulation of both digital and printed newspapers had a 6% decline rate from the previous year. The average circulation of weekday newspapers was 24.3 million (63.2 million in 1990), while the Sunday newspapers had a circulation of 25.8 million (62.6 million in 1990).

- Since 2004, about 2,100 local newspapers have closed. Simultaneously, 1,800 communities have lost their local newsroom.

- The overall number of articles in local news fell by 16.7% in 2022. It was found that private equity owners cut back on local news coverage to run more national news content.

Financials

The newspaper industry is worth billions. However, with the growth of digital news media, plenty of people expect traditional news sources’ revenue to fall. The fact of the matter is that the revenue of newspaper companies dropped, while the spending continued to grow.

- In 2022, The New York Times Company’s circulation revenue reached an amount of $1.55 billion. The overall revenue consistently increased in 10 years–from 2012 to 2022.

- About 39.8% ($12.4 billion) of newspaper industry revenue is spent on advertisements. This is followed by print subscriptions with 31.0% ($9.6 billion), online subscriptions with 15.0% ($4.7 billion), and others with 14.2% ($4.4 billion)

- The newspaper publishing revenue dropped at an annual rate of 3.7% over the past 5 years. It is expected that the publishing revenue will have an estimated drop of 2.8% with a profit of 3.1% in 2023.

- The projected ad spending in the newspaper advertising market is projected to reach about $5.51 billion this year. It’s expected that most of the revenue will come from the United States.

- Newspaper ad spending is expected to show an annual growth rate of -10.34% between 2023 to 2027. With this annual growth rate, the market volume is expected to be worth $3.56 billion by 2027.

- US newspaper publishers are expected to lose $2.4 billion in ad investment between 2021 and 2026. This is mostly due to the losses in print advertising.

- By 2026, it’s expected that print advertising will fall to $4.9 billion. In 2021, print advertising revenue has a total of $7 billion.

- It’s expected that digital ad revenue will expand by 1% CAGR. This adds $251 million from 2022 to 2026. The revenue will amount to roughly $5 billion by 2026, slightly surpassing print.

- In 2022, the average newspaper export price in the US amounted to $3.1 per unit. The price remained relatively stable compared to 2021; overall, it’s a significant increase.

- By June 2023, the average newspaper import price only stood at $1.0 per unit. Compared to the previous month, the price exhibited a -61.4% decline rate.

- The newspaper exports in the United States decreased by -2% in 2022. Newspaper exports in the United States reduced to $374 million in 2022, which is lower than $377 million in 2021.

- Canada was the top newspaper export market for the United States with 106.4 million units or 88.5% of export value in 2022. This is followed by Germany with 2.9 million units and the UK with 1.4 million units.

- The imports of newspapers, journals, and periodicals into the United States had a total of 128 million units in 2022. The newspaper imports surged to $135 million, which is a lot higher than the previous year ($117 million), showing strong growth.

- Canada was the top supplier of newspapers to the United States in 2022 with 76.2 million units. This is followed by the UK with 42.3 million units. However, the UK accounted for 62% of import value, while Canada only accounted for 28.3%.

- The revenue of newspaper publishers in the US dropped by 52.0% between 2002 and 2020. In 2002, the estimated revenue of newspaper publishers was $46 million, while in 2020, the estimated revenue was only $22 million.

- Gannett’s revenue dropped 7% during Q2 2023. Compared to the same period last year, the revenue dropped to nearly $749 million. However, the company’s operating expenses went up 1% from last year, almost reaching $770 million.

- During the first quarter of 2023, Gannett reported a profit of $10.3 million. Despite the huge profit, the rate of revenue fell by 10.6%.

Leading Newspapers

Newspaper companies are ranked based on their number of circulations. The five biggest US newspapers are The Wall Street Journal, The New York Times, USA Today, The Washington Post, and the Los Angeles Times.

- The average circulation of The New York Times printed newspaper in 2022 was approximately 310,000 for weekdays and 745,000 for Sundays. In The New York Times 2022 Annual Report, The newspaper agency has the largest daily and Sunday print circulation of all 7-day newspapers.

- As of August 2023, The Wall Street Journal has an average of over 3.9 million in total circulation. About 560,000 circulations came from print media and 3.4 million came from digital-only news subscriptions.

- USA Today had a total of 163,036 daily circulations in December 2022. This figure includes the combined average circulation of print, digital replica, digital non-replica, and affiliated publications.

- The circulation of the largest US newspapers fell 14% in the year to March 2023. The average daily print circulation of the 25 biggest daily newspapers was 2.6 million. In 2022, the average was 3 million.

- America’s 3 biggest newspapers have lost a total of more than 500,000 in print circulation between the first quarter of 2020 to March 2021. These are the Wall Street Journal, the New York Times, and USA Today.

- Since March 2020, USA Today lost 303,000 of its circulation. USA Today was the worst-performing among all the top 25 newspapers during this period, having lost 62% of its circulation. The company was badly hit because of the lost sales to hotels that would provide free copies of the newspaper to their guests.

- In the same period, The Wall Street Journal lost 208,000 of its circulation. The Journal followed USA Today, losing 21% of its circulation due to the same reason.

- The New York Times’ circulation during the same period performed a lot better as its average weekday circulation only fell by 48,000. The newspaper performed better compared to WSJ and USA Today with only 12% of lost circulation.

Employment

Since 2008, the whole industry has been falling behind in employment. The recent layoffs didn’t help either. Countless journalists, news analysts, and reporters were laid off recently. If not laid off, workers are struggling to get fair compensation.

- As of December 2022, the New York Times has approximately 5,800 full-time employees. More than 2,600 of these employees are involved in the journalism operation.

- About 42% of New York Times’ full-time employees were represented by unions in 2022. This includes technology employees who formed their own union in the same year.

- In 2021, only 11% of high-circulation newspaper companies experienced layoffs. The year had the lowest percentage of layoffs in large newspapers since 2017.

- In the same year, only 3% of digital-native news outlets with high traffic experienced layoffs. These digital news outlets have an average of at least 10 million unique visitors per month. This is also the lowest figure for layoffs since 2017.

- Between 2014 and 2022, the number of full-time newspaper statehouse reporters went from 374 to 245. Full-time statehouse reporters include those who report on the statehouse full-time all year and those who only report during a legislative session.

- US newsroom employment has fallen by 26% between 2008 and 2020. There were about 114,000 newsroom employees in the US in 2008. In 2020, there were only 85,000.

- In 2023, the headcount in some newspapers has fallen by as much as 90%. In Gannett alone, the workforce shrunk by 47%. Last year, the company cut 6% of its roughly 3,400-person media division in the US.

Consumption

With the rise of digital media, it only makes sense for consumers to switch to digital-native news outlets as well. However, there are still plenty of people who get their daily news from traditional newspapers.

- The New York Times Company’s digital-only news product had a total of 6.54 million subscribers in the first quarter of 2023. Since the product started in 2014, the company has seen a consistent growth trend in its quarterly numbers.

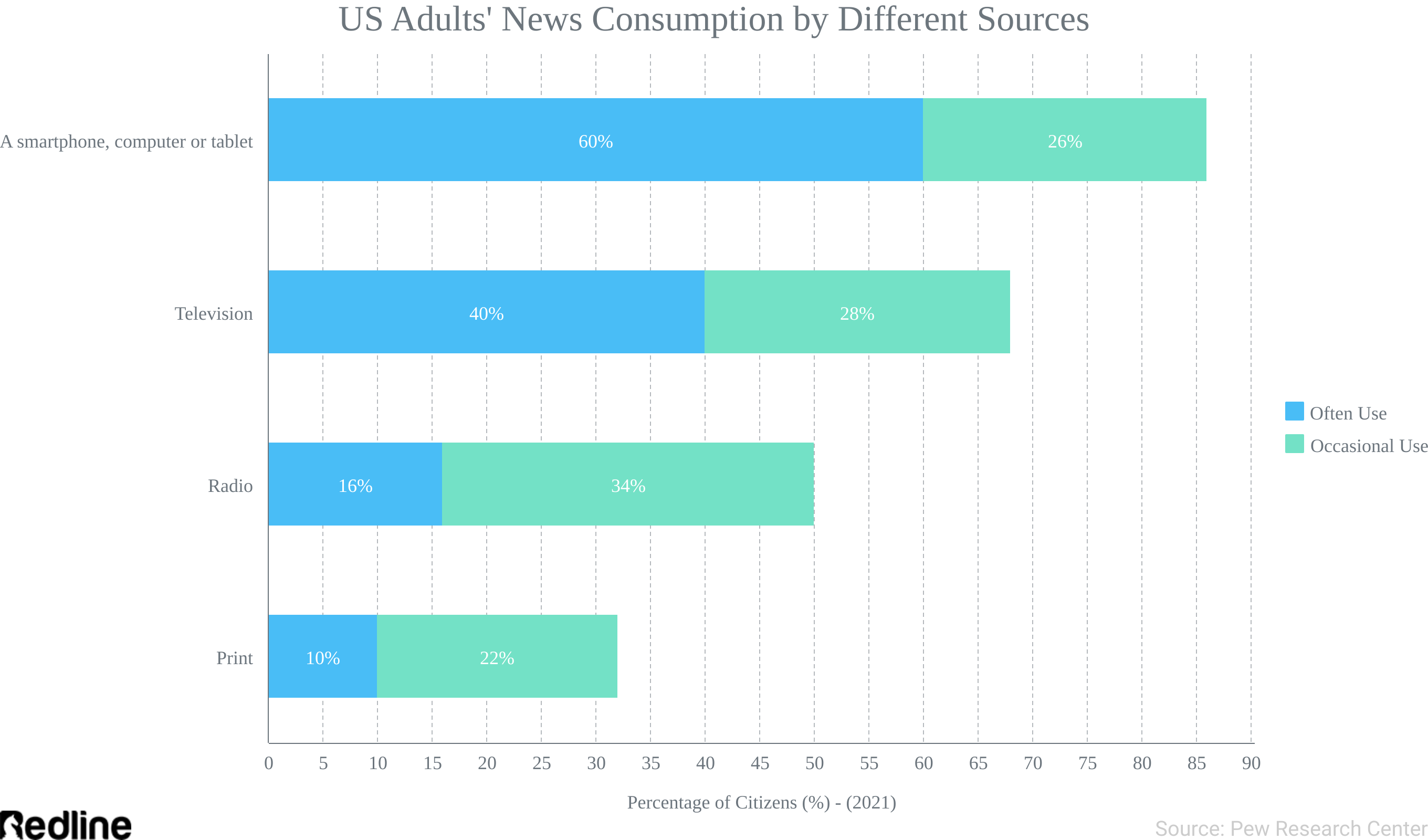

- As of 2021, about 86% of adults in the US get their news online, either via mobile or desktop. About 60% of these individuals get their news from their devices often, while 26% of them do so sometimes.

- Only 32% of American adults turn to print publications for news in 2021. About 10% of these adults often get printed newspapers, and 22% do so sometimes.

- Only 5% of Americans prefer getting news from printed media. Roughly half of Americans (52%) prefer getting their news from digital platforms.

- In a survey held by Reuters, only 22% of the respondents prefer starting their news journey consumption with an app or a website. This figure is 10 percentage points lower than it was in 2018.

- About 21% of US respondents paid for online news in 2022. Norway has the highest number of consumers who subscribed to digital news with 39%, followed by Sweden with 33%.

- In 2022, only a total of 12% of the US population turned to newspapers for their daily news consumption. Men (16%) tend to consume newspapers more than women (8%).

- In the same year, about 37% of the US population turned to social media platforms for their daily news consumption. About 39% of women use social media for daily news consumption and 34% of men do so.

- In 2022, only 7% of US adults are reading the national newspapers daily and 11% are reading the local newspapers daily. More than half of US adults (55%) never read national newspapers and almost half of them (42%) never read the local newspapers.

- A total of 74% of Gen Z and Millennials consume news from traditional outlets at least weekly. Only 45% of people from these two generations consume traditional news outlets on a daily basis.

- Older Millennials (51%) are more likely to rely on traditional news sources on a daily basis compared to Gen Z (39%) and younger Millennials (43%). The same holds true for weekly traditional news consumption. About 81% of older Millennials rely on traditional resources weekly; 67% of Gen Z and 74% of younger Millennials do so.

FAQs

How big is the newspaper industry?

It’s a billion-dollar industry. In newspaper advertising alone, the projected spending for this year is about $5.51 billion. Most of the revenue is expected to come from the United States. But aside from that, there are also newspaper exports and imports. The newspaper exports in the US amounted to $374 million in 2022, with Canada and Germany as its primary export markets. The newspaper imports are also showing strong growth with $135 million.

What are the big 3 US newspapers?

Newspapers are ranked based on their number of circulations. The top 3 newspapers in the country are The Wall Street Journal, The New York Times, and USA Today. The WSJ has an average of over 3.9 million in total circulation as of August 2023. The average circulation of The New York Times printed newspaper in 2022 was approximately 310,000 for weekdays and 745,000 for Sundays. And, USA Today had a total of 163,036 daily circulations in December 2022.

What are the challenges faced by the newspaper industry?

The newspaper industry is currently experiencing plenty of challenges in the age of digital communication. In terms of financials, the revenue of newspaper publishers in the US dropped by 52.0% between 2002 and 2020. When it comes to circulation, the largest US newspapers’ circulation fell 14% in the year to March 2023. The average daily print circulation of the 25 biggest daily newspapers was 2.6 million. In 2022, the average was 3 million. Employment is also a challenge as the headcount in some newspapers has fallen by as much as 90%. In Gannett alone, the workforce shrunk by 47%.

Who owns the most newspapers in the US?

There are 16 largest newspaper owners in the United States. Gannett tops the list with 487 total papers, followed by Tribune/MediaNews Group with 190, Lee Enterprises with 152, Adams Publishing Group with 142, and Paxton Media Group with 120 papers owned.

Do people still read newspapers?

Yes. Despite the prevalence of technology, there are still people who read newspapers. A total of 74% of Gen Z and Millennials consume news from traditional outlets at least weekly. In addition, 45% of people from these two generations consume traditional news outlets on a daily basis. More than half of Older Millennials (51%) are more likely to rely on traditional news sources on a daily basis compared to Gen Z (39%) and younger Millennials (43%).

Sources

- statista.com

- nytco-assets.nytimes.com

- pewresearch.org

- ibisworld.com

- localnewsinitiative.northwestern.edu

- reutersinstitute.politics.ox.ac.uk

- washingtonpost.com

- sec.gov

- usnewsdeserts.com

- theajp.org

- axios.com

- indexbox.io

- census.gov

- americanpressinstitute.org

- apnews.com

- seattletimes.com